Moat Analysis

What is a

Moat?

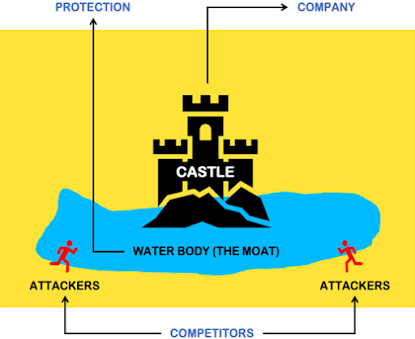

The

dictionary meaning of moat is a deep, broad ditch filled with water that

surrounds a castle historically to provide a preliminary line of defense. It

was like a ‘safety arrangement’ built around the castle in ancient times. Moat

serves to protect those inside the fortress and their riches from outsiders.

The wider and deeper the moat, more protected is the castle. It acts as an

obstruction for the attackers to get access to the castle.

How can

Moat help us in stock investing?

Assume that the company in which you are willing to invest is a castle. Prosperous castles are always subjected to attackers which try to take away the riches of the castle. Attackers here refer to the competitors which force the company to lower its margins and profits. Moat helps to protect the castle from the attackers. Moat here refers to the competitive advantage that helps the company to protect its margins and profits.

Why is Moat

necessary for a company?

Moat is a

characteristic that allows a company to generate high returns on capital for an

extended period. It acts as a barrier that protects a company from its

competitors. In today’s market, any product or service will eventually get duplicated,

and profits of the company will begin to fall. No matter how big or profitable

the company is, if there is no moat, it will not remain competitive. Hence,

building a moat in the company is crucial.

Factors that help to build an Economic Moat

1) High switching cost

Switching cost is the cost that the consumer must incur for switching its preference in terms of brands, products, or service. Although most prevalent switching cost are monetary in nature, but they also include psychological, effort or time-based switching cost. Higher the switching cost, better it is for the company as the customers will not easily change over to another company. There are certain businesses where customers find it difficult to switch over to competitors either due to cost or due to hassle in doing so.

For example: In the early 21st century, telecom companies retained customers as they enjoyed switching cost advantage. This is because, if you wanted to change your provider back then, then you had go through a tedious process and also lose your existing phone number.

2) Cost

Advantage

A company is said to have cost advantage when it can produce a product or provide a service at a cost lower than its competitor. Cost advantages exist when a company builds a more efficient manufacturing or distribution and use that to offer lower prices than competitor. If you can make it for less, you can sell it for less. Cost advantage helps the company to provide same level of service or product but at a lower price. This is mainly possible due to economics of scale. Companies with significant cost advantage can undercut the prices of competitors that tries to enter their industry, either by forcing them to leave or restricting their growth. Such companies can easily maintain their market share within the industry by squeezing out new competitors.

For

example: Walmart is known for selling branded products at low cost. Walmart

has been effective in establishing cost advantage through process automation,

minimum human resource expenditure and close relation with suppliers.

3) Network effect

Network

effect is one of the most powerful moat and easiest to spot. It works on the

formula that existing and satisfied customers brings more customers which in

turn creates a wide network of customers. It works on the principle of ‘word of

mouth’. As more people use a company’s product, the value of product or

services increases for both new and existing users. More customers mean greater

market share, higher revenue which in turn generates higher profits.

For

example: Facebook enjoys network moat. It is the largest social media platform

with 2.6 billion monthly active users. Majority of the population has an

account on Facebook. So, every adult who is a non-Facebook user also wishes to

open his account on Facebook.

4) Intangible Assets

Intangible assets are unique non-physical assets that gives a competitive advantage to a company. They include patent, copyright, trademark, and government license. Intangible assets help the company to safeguard key competitive advantage. They act as a barrier to entry for new entrants.

For

example: Whenever pharmaceutical company develops a cure for a diseases, they

file and get patent for the same. Patent ensures that competitors don’t imitate

the drug and sell it under their brand name. Patent provides protection to the

company’s innovation for a couple of years. Even after expire of patent,

competitors cannot use the same name but they can launch a similar generic

drug.

How economic moat helps to generate more

profits?

Economic

moat give pricing power to the company. Pricing power refers to the company’s

ability to raise price without reducing the demand of its product. More the

pricing power of the company, easier it is to raise price. Pricing power could

be achieved by brand, loyal customers, quality products etc.

Amul has a

very good pricing power. In last 10 years, even after hiking price by 88% (from

24 per liter to 45 per liter), Amul was able to increase its sales quantity by

a whopping 312% (from 17000M liters to 70000M liters). This shows the pricing

power of Amul.

How to

identify a company with a moat?

Now that we are clear with what moat means and how it is established, lets see how we can identify them:-

- 1)PAT

Margin: PAT margin helps to express profitability of a company. PAT is

expressed as a percentage of sales.

PAT Margin = Profit After Tax / Sales

Companies having moat enjoy pricing power and cost advantage. This helps

the company to a higher profit margin than its competitors.

As a rule of thumb, a company with net margin of more than 15% is considered good. But check for consistency of PAT margin over a period of 5 or more years.

-

2)Return

of Equity: ROE is a financial ratio that helps to measure a company’s proficiency

to generate profits from shareholder’s investment. This helps to gauge a

company’s effectiveness in using its equity funding to run its operations.

ROE = Net Profit / Equity

Companies with moat enjoy pricing power. This helps them to earn high

profit.

As a rule of thumb, a company with an ROE of more than 15% is considered good. But check for consistency of ROE over a period of 5 or more years.

-

3)Cash

in Hand: Profit is subjective but cash is objective. Companies with moat

usually have a huge pile of cash either reinvestment or as a reserve against

uncertain short-term disruption.

As a rule of thumb, check for companies with increase in cash in hand with increase in sales over last 5 or more years.

Following is the list of 15 companies that satisfies the above mentioned criteria:

To get the whole list of companies that satisfies these criteria Click Here.

To sum up,

A company with a wide moat is definitely a company worth investing and will create a lot of value for its shareholders. It will remain profitable even during volatile situation. As an investor, look for companies with above mentioned characteristics and do your exhaustive research before investing in it.

Happy Investing!

To know more about moat read Why Moat Matter.

Disclaimer: Companies used as an example in this blog are for educational purposes and not an investing advice.

In the next blog we will understand 10 listed companies which have a wide moat.

Connect with me on LinkedIn to stay tuned.

Comments

Post a Comment