Herfindahl-Hirschman Index (HHI)

What is Herfindahl-Hirschman

Index (HHI)?

HHI is a score

that helps to measure market concentration and used to determine market

competitiveness. HHI is named after economists Orris C. Herfindahl and Albert O.

Hirschman. It is an economic concept widely applied in competition and

antitrust law. A highly concentration industry is the one where only a few

players dominate the industry by holding a huge market share, leading to a

near-monopolistic industry. Conversely, low degree of concentration refers to

near-perfect competition scenario where many companies hold small market share.

Why is HHI

important to an investor?

HHI helps

to measure market concentration which in turns helps us to determine

profitability is the industry. There is a direct relation between market concentration

and profitability. Low concentration perfect market and in perfect market there

is cut-throat competition. So, it is difficult for the firm to earn above

average returns. High concentration indicates near-monopolistic market and

monopolistic market helps the firm to earn above market return. As an investor,

it is important for us to known profitability of the industry. So, we should

check HHI of the industry before investing in the company.

HHI

Calculation

HHI is

calculated by squaring the market share of each competing firm and then summing

the resulting numbers. HHI value can range from 0 to 10,000. The HHI can have a

theoretical value ranging from close to zero to 10,000. If there exists only a single market

participant which has 100% of the market share the HHI would be 10,000. If there were a great number of market

participants with each company having a market share of almost 0% then the HHI

could be close to zero.

Formula:

Example:

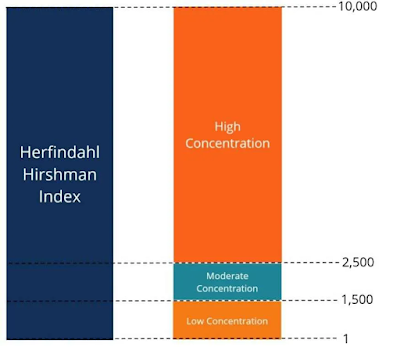

In the above question we can see that HHI of the industry is 2192. Does 2192 indicate high concentration or low concentration? Let us understand what each value of HHI mean.

Interpreting

HHI value

HHI score is directly proportional to the concentration in a particular market. That means, a higher HHI value or score reflects a higher concentration in industry and thus reflects lesser competition. Similarly, a lower HHI score would entail the presence of good competition around firms in an industry. A value closer to 10,000 or 1 would indicate the presence of monopoly and a value closer to 0 would indicate healthy competition and almost null concentration among firms.

Value between 0 to 1500: It indicates that the industry has low concentration and a competitive industry.

Value

between 1500 to 2500: It indicates that the industry is moderately concentrated

and a healthy competition.

Value higher than 2500: It indicates that the industry is highly concentrated and is a near-monopolistic market.

The primary

advantage of HHI is that it is simple and is less dependent on huge data sources. Rather, it requires only a handful of data to

calculate HHI index. But there are some limitations of HHI. Let us understand

those.

Limitation

of HHI

A major

disadvantage of HHI is that it is simplistic in nature. Since, the formula is

simple it fails to undertake various market adversaries and complexities that

are present in today’s market structure. For example, a company may have small

market share but may hold a dominant position in a particular geographical

market. Also, limitation of defining a market persists in a scenario where

intra-industry competition exists. An industry would look competitive, but each

firm may hold dominant position in a particular market segment. For example, Asian

paints is a dominant player in home decor paint while Nerolac is a dominant

player in industrial paint segment.

To Wrap Up,

Despite its limitation, HHI is a good tool to assess market concentration. High HHI indicates high concentration industry with above average profits. Conversely, low HHI indicates low concentration and below average profits. As an investor, we should invest in companies which come under high concentration industry. Along with HHI, we should also perform PESTLE and Porter analysis and do our own exhaustive research to understand industry structure.

Happy

Investing!

Disclaimer:

Companies used as an example in this blog are for educational purposes and not

an investing advice.

Comments

Post a Comment